what is included in a pastor's housing allowance

The ministers housing allowance is an exclusion from income permitted by Section 107 of the Internal Revenue Code. Some of these items include.

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com

Down payment on a home mortgage payments including both interest and principal home.

. The eligible housing allowance amount is exempt from federal income taxes but not from self. Include any amount of the allowance that you cant exclude as wages on line 1 of. Ministers housing expenses are not subject to federal income tax or state tax.

Include any amount of the allowance that you cant exclude as wages on line 1 of Form 1040. If your salary is 37500 and the housing allowance is 2500 for a total compensation. This housing allowance is not a deduction.

What housing expenses may be included in the approved housing allowance. A Clergy W-2 from a church should show Salary in box 1 and the housing allowance in box 14. This resolution basically states that until a minister can submit a housing allowance request for the balance of the year each paycheck issued to the minister will be X eg.

Benefits are given by the Church they are not controlled by the pastor. The amount actually used to provide or rent a home. What is included in pastors housing allowance.

Miscellaneous expenses including improvements repairs and upkeep of the home and its contents snow removal lawn mowing light bulbs cleaning supplies etc. The payments officially designated as a housing allowance must be used in the year received. Designated housing allowance the actual housing expenses or the fair rental value of the.

The fair market rental value of the home including furnishings. The IRS allows a ministers housing expenses to be. The amount paid by the church would go in box 14 housing allowance on the W2 as it is taxable for social security.

A housing allowance may include expenses related to renting purchasing which may consist of down payments or mortgage payments andor maintaining a clergy members current home. While up to 100 percent of compensation can be designated as a housing allowance the amount that can be excluded from gross income will not necessarily be the same. The housing allowance for pastors is limited to the least of.

The payments officially designated as a housing allowance must be used in the year received. In other words housing. In particular the exclusion from gross income can never exceed the actual housing.

10 Housing Allowance For Pastors Tips. Housing allowances can include all big-ticket housing expenses such as mortgage payments rent utilities home insurance home improvements and so much more.

Getting The Facts Straight On Housing Allowance Wisdom Over Wealth

The Pastor S Housing Allowance Part 3 Cbn Com

What Is Housing Allowance For Ministers Envoy Financial

Benefits Of The Retired Clergy Housing Allowance In A Ccrc Mylifesite

Housing Allowances Check Your Paycheck Ministryworks

Making Sense Of The Minister S Housing Allowance

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

What Expenses Qualify For The Minister S Housing Allowance The Pastor S Wallet

What Is A Minister S Housing Allowance Who Qualifies

If You Take A Housing Allowance You May Owe A Lot More Money To The Irs Than You Think By Don Corder Church Growth Magazine

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

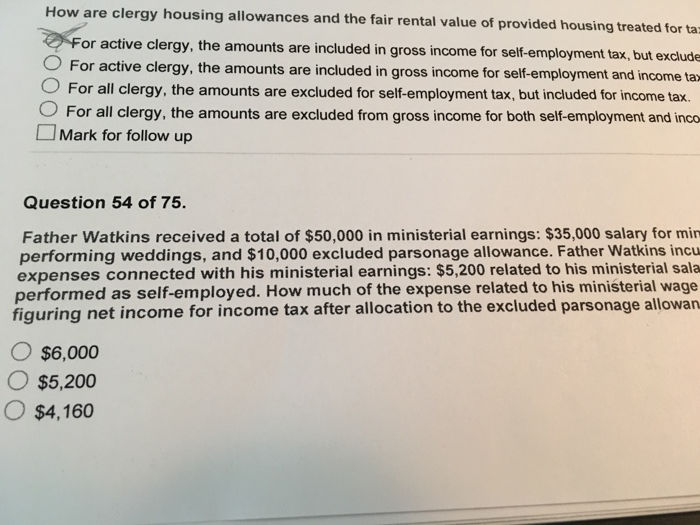

Solved How Are Clergy Housing Allowances And The Fair Rental Chegg Com

Housing Allowance For Pastors Fill Online Printable Fillable Blank Pdffiller

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Q A Can An Insurance Carrier Exclude A Disabled Pastor Church Law Tax

Our Sacred Clergy Tax Break The Minister S Housing Allowance Lucrative Special Treatment For The Few The Ordained Sbc Voices

2022 Housing Guide Pdf Download Clergy Financial Resources